FORTNIGHT ISA MULTIMEDIA DOCUMENTARY PROJECT ON THE MILLENNIAL GENERATION: THE LAST GENERATION TO REMEMBER A TIME WITHOUT THE INTERNET. |

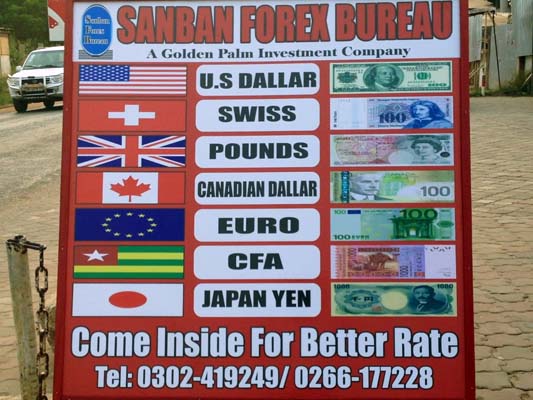

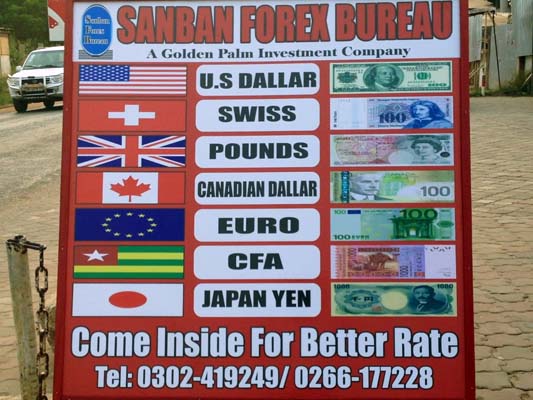

GOLDEN INVESTMENTS

GOLDEN INVESTMENTS

GHANA CATCHES UP IN WORLD EXCHANGE:

SANGU TAKES US INSIDE AGRIBUSINESS AND

HEALTHCARE JOB CREATION.

read the essay now >>

GHANA CATCHES UP IN WORLD EXCHANGE:

SANGU TAKES US INSIDE AGRIBUSINESS AND

HEALTHCARE JOB CREATION.

read the essay now >>

|

My last entry described the origin and success of Project ACWA, the water sanitation social enterprise I co-founded in southern Ghana. It was around that time—2007—that we held a community meeting, seeking input. As I mentioned in my first Fortnight piece: I asked one of the villagers in Agyementi, “What is the single greatest thing I can do for your community?” Expecting him to say “build a hospital” or “build a school,” I was stunned by his response. “Jobs,” he said. “We want jobs.” Inspired by this, I founded Golden Palm Investments with all of $100. When filling out the business registration form, I wasn't particularly sure what exactly we would do—so I wrote every industry on it. The only thing I knew is that we would be an investment company, focused on venture capital and early-stage private equity, with a specialty in small and medium enterprises and start-ups. We began with agribusiness. We invested in one thousand acres of corn farms, importing tractors from China to advance yields through mechanized farming. Our core philosophy the old adage of doing well while doing good. We had learned already that the key to real and sustained development in Africa is to move away from the aid-reliant model, and toward an incentive-based |

model that fosters entrepreneurship and market growth. People grow out of poverty when they create small businesses that employ their neighbors. Nothing else lasts. People grow out of poverty when they create small businesses that employ their neighbors. At GPI, our focus became creating, establishing, supporting and investing in small businesses, with a secondary goal of generating job creation. At GPI, supporting the African entrepreneur is at the core of our investment strategy. It not only fulfills our belief in corporate social responsibility; it also provides optimal exit strategies via local entrepreneurs to finance buyouts and equity investments.At GPI, then, we originate structure in investing—everything from management lead buyouts and strategic minority equity investments, to equity private placements and venture and growth capital financing. While we are generalists, we have now developed five key areas of attention: financial services, real estate, health care, agribusiness and, most recently, media and technology. Our long-term goal is to become the leading investment company in Africa that would support growth development, job creation and economic development of the region. |

|

We started in Ghana partly because I am from there, but more importantly, because of the opportunities we see there. Ghana is forecasted to be the fastest-growing economy in the world in 2011, with an estimated GDP of 71 billion dollars at present. Economic growth has remained strong, with real GDP growth reaching an estimated 5.9% in 2010, compared to 4.2% a year earlier. Some growth estimates are even more optimistic, largely on account of oil production in commercial quantities that started toward the end of 2010. But it is also a testament to Ghana's increasingly democratic social stability, which boosts investor confidence. Rising investment leads directly to an increase in Foreign Direct Deposit (FDI). It must also be said that the country's strong growth has been achieved within a strong macro-economic environment. The prudent fiscal and monetary management clearly contributed to the easing of inflationary pressures, and the decline of interest rates. The private sector has responded positively to the Ghanaian government's development programs over the past decade. Investor confidence is seen in the rise of bank lending and capital inflows. And new partnerships between Ghana and remerging economies, such as China and South Korea, are providing additional sources of financing and expertise for development. In fact, China recently gave the government a 3 billion dollar loan to be used for |

infrastructure development. This loan will not only provide jobs, but also build the necessary infrastructure for Ghana to experience transformational growth. But it is also a testament to Ghana's increasingly democratic social stability, which boosts investor confidence. At GPI, we take pride in the fact that our focus isn't just on generating profits or aiming for returns (though we of course maximize returns for our shareholders and generate profits). It is equally important to align the interests of the communities whose resources we use with those of the communities that end up being the beneficiaries of our services.We have created, on a permanent and temporary basis, 200 job opportunities. We do so by investing the development of these communities. Tallying the numbers from all the different projects in all the different sectors and divisions we cover, we have created, on a permanent and temporary basis, 200 job opportunities. That is a number I am very proud of and something that I hope that we can continue. As founder and CEO, I consider job generation one of our supreme goals. |

|

Harry Truman once said that healthy citizenry is the most important element in national strength. According to the International Finance Corporation, IFC, subsaharan Africa has about 11% of the world's people, but carries 24% of the global disease burden in human and financial costs. Almost half of the world's deaths of children under five take place in Africa. This challenge is significant, but not insurmountable. There is a tremendous possibility to leverage the financial sector in ways that improve access, increase financing and enhance the quality of healthcare goods and services throughout Africa. In a region where public resources are limited, the private sector is already a significant player. Around 60% of healthcare financing in African comes from private sources. About 50% of total health expenditure goes to private providers. Just as important, the vast majority of the region's poor people, both urban and rural, rely on private health care. A poor woman with a sick child is as likely to go to a private hospital or clinic as to a public facility, according to IFC research. At GPI, we clearly saw the healthcare industry as a promising one, and made the case for investing in healthcare. We realized that the weak investment climate in Sub-Saharan Africa posed a daunting challenge to entrepreneurs and their potential backers alike. But in the past few decades, we have |

Economic growth in most of the continent has been strong for the past half decade, and inflation is down. Reform is also beginning to take hold. Investment opportunities in healthcare are also growing apace. The expected improvement in Africa's macro-economic climate of the next decade will expand the healthcare gap, because higher incomes will create new demand. The biggest individual investment opportunities will be in building and improving the sectors' physical assets. An additional 90,000 physicians, The IFC estimates that an additional 650,000 additional hospital beds will need to be added to the existing base. An additional 90,000 physicians, 500,000 nurses and 300,000 community health workers will be required over and above the numbers projected to graduate from existing medical colleges and training institutions. Demand for better distribution, better retail systems and pharmaceutical medical supply and production facilities will also be very strong. An estimated 25 billion dollars of investment will be needed to meet demand between now and 2016—of which 11 billion dollars is likely to come from the private sector.500,000 nurses and 300,000 community health workers will be required... |

|

Clearly, for a small firm like GPI, we cannot have a huge impact right away. But it is interesting to note that according to the IFC, the vast majority of the investments in the near term will be in the SME sector (small-to-medium enterprises). Only a quarter of investment opportunities are expected to have a project size that is larger than 3 million dollars. So 75% of all needed investment in healthcare is expected to come from SMEs at less than 3 million dollars. We decided to establish a small hospital in Tema, which is a municipality in the greater Accra region of Ghana. We focused on Tema because we realized it was an underserved market. Accra has a lot of healthcare facilities, relatively speaking. We decided to partner with Rabito Health Services, a pre-established player in the general health care markets. Through the research we did in Ghana, we realized that about 42% of the rural population and 45% of the urban population used private, for-profit providers of medicine. We then saw investment opportunities across all components of healthcare, including construction of physical assets, distribution, retail systems, pharmaceuticals, medical product manufacturing, insurance, and even in the education of healthcare providers. We see high potential in skilled care in high-end hospitals and pharmaceuticals. |

According to the IFC, retail is the most profitable sector within health, with margins varying between 5 to as high as 50%. Significant opportunities for consolidation of pharmaceuticals exist, since most formal outlets are private, single outlet operations. And those that do exist are extremely successful. Some of them have growth rates of over 100% per year. In addition to delivering compelling financial returns, investments in healthcare have enormous potential in developmental impact. En suite with our efforts in water sanitation and agribusiness, we at GPI look forward to a promising future of these healthcare investments spurring further growth and empowerment in Ghana.  *** Sangu Delle is an entrepreneur from Ghana currently based in San Francisco, California. He is founder of African Development Initiative and CEO of Golden Palm Investments LLC, an investment company with private equity interests in agribusiness, real estate, financial services and healthcare. He is currently on leave from his MBA at Harvard University in order to work as Global Generalist at Valiant Capital Partners.His previous essays for Fortnight can be found here: Seeding Growth, Investing in Africa, Investing in Africa II, Developing the Future and Social Entrepreneurship. |